1.) FDX FedEx announces new buyback program

FedEx (FDX) announces a new 32M share repurchase program.The new buyback allowance comes on top of the 7.4M shares still outstanding on a previous repurchase program.FDX +0.8% premarket.

Year to date, FedEx (

FDX) is up more than 25%. Despite the higher

price per share, I still believe FDX is a

good stock for

dividend growth investors. In this article, I will be looking at FDX's cash flows, balance sheet, valuation and dividends. For comparison, I will be using

United Parcel Service, Inc. (

UPS)

Dividends

FDX's dividend yield at current prices is at 0.52%, which is quite low compared to UPS's 2.72%. However, I believe FDX's dividend has a good chance of going up, for these two reasons:

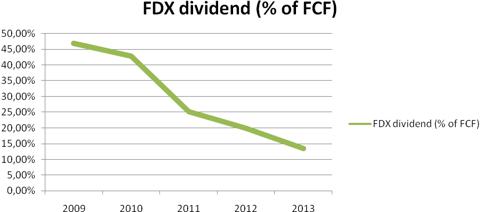

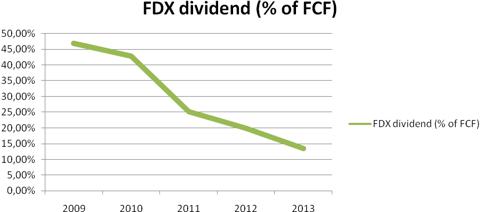

- Between 2009 and 2013, FDX's dividend has grown from $0.44 to $0.56, an increase of 27.2%. Free cash flow has gone from $0.94 to $4.14 per share in the same period. This means the percentage of FCF paid out as dividend has dropped from 46.8% to 13.5%. For comparison, UPS's FCF per share was $5.23 in the most recent fiscal year, while the dividend was at $2.28, giving it a dividend/FCF ratio of 43.6%.

(click to enlarge)

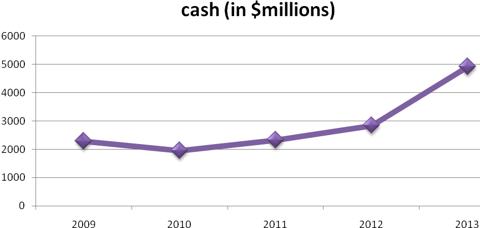

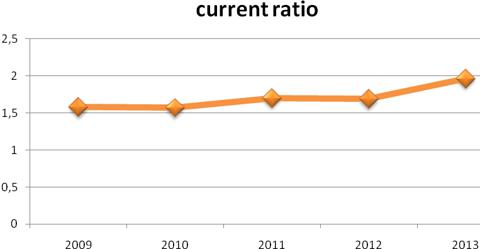

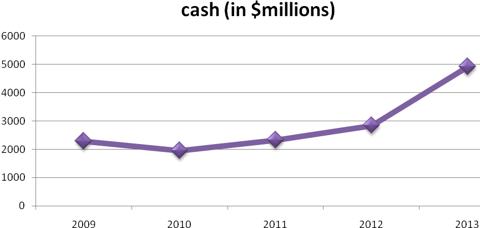

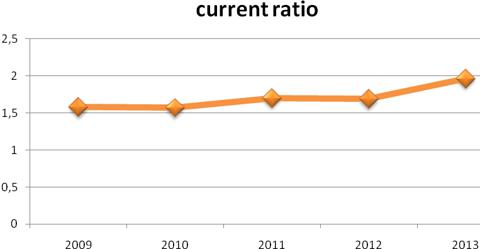

-FDX's low dividend has allowed it to save up a very large sum of money. At the end of FY2013, FedEx had $4.9 billion in cash, or 13.5% of its total market cap. Its current assets have increased at a much higher rate than its current liabilities, causing the current ratio to reach 1.96 at the end of FY2013.

(click to enlarge)

(click to enlarge)

Valuation

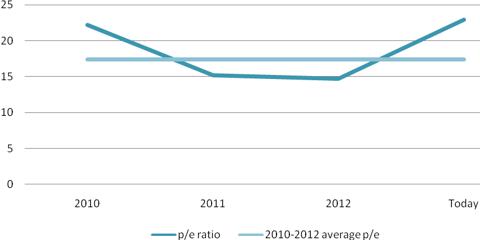

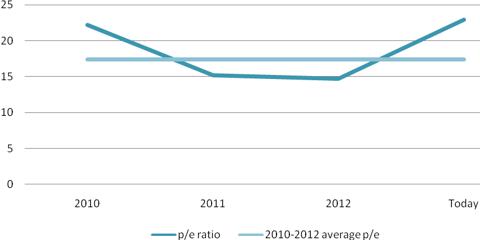

At 22.9 times earnings, FedEx looks very expensive. Between 2010 and 2012, the

average price to earnings ratio was at 17.4. However,

analysts expect FDX to reach EPS of $6.98 in

fiscal year2014, and $8.69 in 2015, which means the stock is now selling for 16.4 times expected earnings in 2014 (the current fiscal year) and only 13.2 times the expected earnings in 2015. UPS is currently trading at $91.26, which is 16.7 times the expected earnings for the next fiscal year.

(click to enlarge)

Conclusion

While at first glance the low dividend and relatively high price to earnings ratio makes FDX looks like a stock a dividend-orientated investor should avoid, a deeper look at the company makes it look very attractive. By paying a small dividend, FDX has managed to save up billions of dollars. The current dividend is only 13.5% of the free cash flow. Earnings were down in FY 2013, but are expected to grow by double digits in both the current fiscal year and next year. FedEx's first quarter for the current fiscal year ended a few days ago, with earnings per share of $1.53, 5.5% higher than in the first quarter of last year.

2.) Qihoo 360 Technology (QIHU) reported 2Q earnings per ADS of $0.26 vs $0.06 last year on revenues of $151.7M, up 108% YoY. Looking ahead, the Co said "For the third quarter of 2013, the Company expects revenues to be between $181 million and $183 million, representing a year-over-year increase of 115% to 118%, and quarter over quarter increase of 19% to 21%

Qihoo 360 Technology Co. Ltd. provides Internet and mobile security products in the People’s Republic of China. Its core Internet security products include 360 Safe Guard, a solution for Internet security and system optimization; 360 Anti-Virus, an anti-virus application that uses multiple scan engines to protect users’ computers against various kinds of malware, as well as 360 Mobile Safe, a security program for the Google Android, Apple iOS, and Nokia Symbian smartphone operating systems. The company’s platform products comprise 360 Safe Browser and 360 Speed Browser, which are based on dual-core technologies providing secure browsing and blocking malicious Websites, indentifying them among search results, scanning files downloaded through the browser for security threats, as well as 360 Mobile Browser for the iOS and Android operating systems. The 360 browsers also consist of 360 Personal Start-up Page, which serves as user’s start-up page aggregating preferred Web services and applications; 360 Search, a search engine; and 360 Mobile Assistant, which allows users to browse, search, and obtain various mobile applications for mobile devices. Qihoo 360 Technology Co. Ltd. also provides online advertising services, including online marketing services and search referral services; and Internet value-added services comprising the operation of Web games developed by third-parties, remote technical support, and cloud-based services. The company was formerly known as Qihoo Technology Company Limited and changed its name to Qihoo 360 Technology Co. Ltd. in December 2010. Qihoo 360 Technology Co. Ltd. was founded in 2005 and is based in Beijing, China

3.) Central Fund of Canada (CEF) has been providing a reliablestock market vehicle to

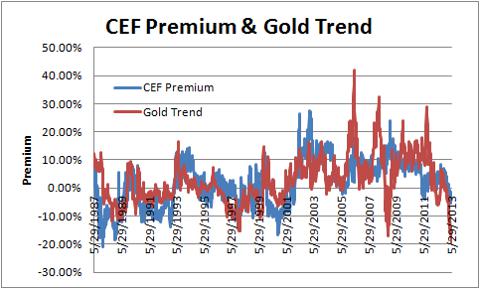

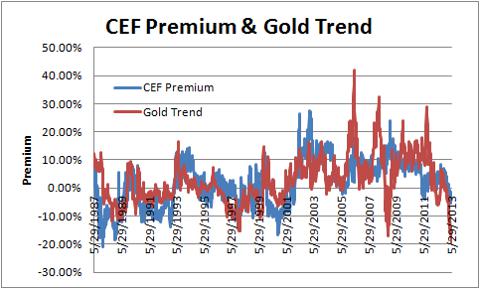

invest in precious metals since 1961. CEF is a closed-end fund investing in gold and silver and is an alternative to GLD and SLV. As a closed-end fund, it can trade at a premium or discount. Please see chart below for the time series of how it is traded relative to NAV. It is easily seen that CEF has, for the last 8 years or so traded at a premium to its NAV. Now, in this precious metals sell-off, it has begun trading at a discount. It is currently trading at a 6.5% discount, which is close to the largest discount since June 2005. The question is whether this is an opportunity to buy gold and silver at a discount to their market prices or whether the discount widens further.

(click to enlarge)

(source Bloomberg)

First, let's look at the mechanics. The Fund makes it easy to calculate the NAV. The Fund's

site provides all of the relevant information. Currently, the Fund holds ~1.7M oz of gold and ~77M oz of

silver, plus ~$40M cash. Simply use the exact values from the site and multiply by current

spot prices for

gold and silver and then the cash to calculate total NAV for the Fund. Divide by the number shares, which is also given on that page. This is all straightforward. Be sure that you are using the spot price of the metals, not GLD, SLV or futures prices. Keep in mind that for gold, spot has recently traded slightly above the active futures price, which is unusual, particularly when the futures curve is in contango.

If one does some additional research, including reading the

annual report [pdf], there is some key additional information to be aware of. First, management of the Fund will periodically sell additional shares. Check the notes on pages 11-12 regarding

Capital Stock. On three occasions, in 2009, 2010, and 2011, additional shares were issued. On April 6, 2011 the Fund issued shares and that drove the premium down to zero and below (see graph above). The premium re-appeared but at a lower average level than where it had been since 2005. Offerings in 2009, and 2010, do not appear to have impacted the premium for Fund shares. One final important tidbit worth mentioning is also in the Capital Stock note: since October 1989, class A stockholders (the shares) can redeem their shares for 80% of the NAV of the fiscal quarter.

Down with a Discount

Now we can verify current market prices of CEF and its NAV and we see that we can get this basket of precious metals at a 6.5% discount to current spot prices. It is clearly an attractive proposition to purchase the metals cheaper than what the market is currently offering. CEF is a closed-end fund (I won't abbreviate it as CEF to avoid confusion with the Fund), and there is no creation/redemption mechanism for keeping the market value of CEF in line with its NAV. The only mechanisms available are investor rationality, the 80% redemption mentioned above and the ability of CEF management to issue more shares. Statistically, CEF has traded at a premium for the past 8 years or so and it seems reasonable that trading at a premium is "normal." At first glance, scooping up CEF at a discount seems like a no-brainer.

However, for all of that time, gold and silver have been in a bull market. During a bull market, it makes sense if investors were perhaps too aggressive in their purchases of gold- and silver-related assets. So it is worthwhile to look at CEF performance prior to 2001 when gold was at the bottom of its last bear market. Here is a graph going back to April 1986 (source: Bloomberg):

(click to enlarge)

Now the picture looks very different. One can see the premium seems to be correlated to the trend of gold. To get a better handle on this, I will create a series to proxy the "trend of gold" as the weekly close of spot gold divided by its 52 prior weeks' moving average less 1. This will give a percentage "premium" of the weekly close to the moving average. The idea being that it will parallel the percentage premium of the weekly closing price for CEF. The following graph shows the two time series (source Bloomberg).

(click to enlarge)

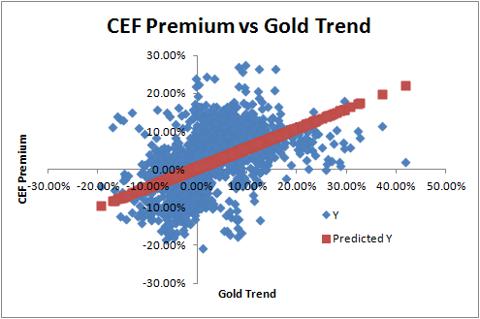

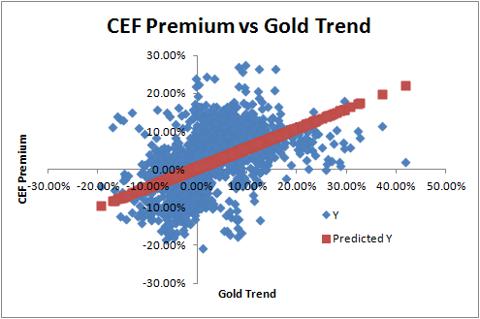

And here is a scatter graph with regression line. In both, there are some outliers, but the basic story that the premium of CEF is closely correlated to gold's trend is accurate; 77% of the sample can be found in either the top right or bottom left quadrants, meaning that direction matches, even if magnitude is less predictable.

(click to enlarge)

The Opportunity

There are two ways to take advantage of this. Choose CEF to get long precious metals as an alternative to buying gold and silver in some other way or to create an arb type position if one is neutral on metal. The key to this trade is that you need the discount to diminish. There is no yield or other advantage accruing to the holder (CEF does pay a small .01 annual dividend but it is small enough to effectively ignore). Currently, gold is 22% below its trend as I defined it above. For the indicator to go positive would require gold to bounce to $1600/oz; $1600/oz does not look likely in the short term.

I believe that 6.5% discount is a good entry point. It still comes with risk. At the extreme, CEF is willing to compensate investors with 80% of the NAV via a redemption process that is untried (as far as I know). There has yet to be sufficient discount to motivate investors to exchange. That makes a hard-ish floor of 20% discount and that seems unlikely, but not impossible. On the other hand, the market could print 10%+ discounts in another sweep down of precious metals and overall risk-off trading. My personal view is that gold is due for a bounce and quarter end could be the catalyst.

To construct an arb trade, one would need to buy an amount of CEF and offset it with an appropriate short in gold and silver. Based on the numbers from CEF, it holds 45.42 ounces of silver for every ounce of gold. Each share of CEF has .00666 oz of gold (1.7M oz / 254M shares - check data for exact figures). Table 1 shows equivalent positions. Note that equivalent positions means combined gold and silver positions vs. CEF position. This is because CEF holds both gold and silver. An example trade would be long 1450 CEF, short 450 SLV and short 100 GLD. There will be tracking error as the positions do not match exactly, but they are small relative to the discount.

Table 1: Equivalent Ratios

|

Per Ounce

|

Per GC Future

|

Per 100 GLD

|

Gold/GLD

|

1 oz

|

100 oz

|

100 shares GLD (9.6643 oz)

|

Silver/SLV

|

45.42 oz

|

4,542 oz

|

454 shares SLV (439 oz)

|

CEF

|

150 shares

|

15,013 shares

|

1450 shares

|

There are some advantages and disadvantages to using GLD and SLV (or other ETFs). The first advantage is that being short GLD and SLV accrues the expense ratio in your favor. That is, if gold is unchanged, the value of GLD declines over time to represent the loss of metal as the administrator removes some of the metal to pay for fees. In addition, the expense ratios for both GLD and SLV are higher than that of CEF, which is typically 0.31% (see the annual report for further details). Another advantage is smaller resolution; that is, one can trade smaller positions with more accuracy. For instance, trading the 100 oz future would require a mis-match of the 5,000 oz silver (SI) contract against a desired position of 4,542 oz. And, of course, any futures position held for some time would potentially require rolling contracts. The main disadvantage is that metals

ETFs are taxed at a higher rate than futures. Check this

article for a recent story about this. There is no way to address each individual's tax situation; this article addresses my market outlook and the mechanics of the trade. Please make a note of margin implications for putting on an arb structure as margin will increase on the short leg if gold rises and might cause an issue for an inappropriately funded account. Any potential trade is something an individual decides for themselves.

Conclusion

A look at the history of CEF premiums shows that its pricing is correlated to the trend of gold. That makes sense and it can be viewed as a bit of a sentiment indicator on gold direction. Gold and silver have sold off in a manner indicating liquidation. It is now just before quarter end and it seems reasonable that the timing might mark a turning point as institutions finish adjusting their balance sheets for the reporting period. Purchasing CEF at a discount to the market price of its assets is clearly an attractive proposition. Nevertheless, it pays to go into a trade with one's eyes open. It is reasonable that the discount could expand toward 10% or more if sentiment worsens. On the other hand, if one is bullish on precious metals, and precious metals do rise, the discount will likely disappear adding an additional 6.5% return to one's investments. The arb looks attractive to begin stepping into. My feeling is that it is not time to take a particularly large position, but it does seem likely that positions will get re-set or initiated after quarter end that will act to add liquidity to areas that have been stressed in this recent yield sell-off.

More recent guru trades are included for

More recent guru trades are included for