U.S. Q2 GDP Growth Expected To Rebound

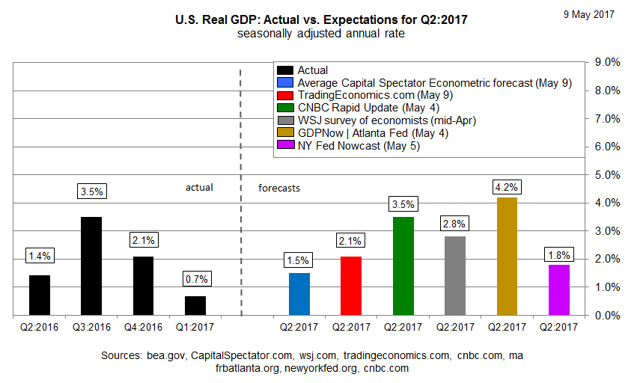

Tepid economic growth in the first quarter is on track to revive in Q2, according to estimates from several sources. Although the forecasts are wide-ranging at the moment, the unifying factor is a widespread view that output will pick up in the second quarter after a sluggish start to the year.

Among the more bullish estimates at the moment is the Atlanta Fed's GDPNow model, which is projecting a dramatic acceleration in growth to 4.2% for Q2 (as of May 4) - far above the stall-speed gain of just 0.7% reported by the Bureau of Economic Analysis for Q1. The GDPNow resonates with the crowd these days in the wake of the model's generally accurate forecast of a sharp deceleration in Q1 growth.

Recent polling of Wall Street analysts reflects an upbeat outlook too, according to CNBC's Rapid Update data for May 4. The survey's median forecast is projecting a solid 3.5% bounce in Q2 growth.

Other estimates see a softer rebound. The New York Fed's latest nowcast, for instance, calls for a 1.8% advance in Q2, based on the May 5 update.

Nonetheless, it's notable that there's widespread agreement that Q1's feeble growth rate isn't expected to deteriorate further in Q2. Surprising? Not really. Recent analysis of business-cycle risk (see last month's update, for instance) has routinely indicated that the probability is virtually nil that the US is slipping into a recession.

The caveat is that there's a long road ahead before the initial Q2 GDP report is published in late-July. A lot could go wrong between now and then, although a lot could go right. In any case, Q2 estimates at this stage are little more than guesstimates.

That said, the early numbers look encouraging, including last week's employment report for April, which revealed a snapback in job creation after a weak gain in March. The Conference Board's (CB) Employment Trends Index, a multi-factor measure of the labor market, is signaling a bullish future too.

"The Employment Trends Index has been expanding rapidly in 2017, suggesting that robust job growth will continue into the summer," says Gad Levanon, CB's chief economist for North America. "A tight labor market is about to get much tighter, with solid employment growth occurring at a time when there is almost no growth in the working-age population."

A new report from Goldman Sachs predicts that the current expansion - 95 months so far, which is the third-longest - will continue to become the longest in recorded economic history for the US. "The likelihood that the expansion will break the prior record is consistent with our long-standing view that the combination of a deep recession and an initially slow recovery has set us up for an unusually long cycle," analysts at the investment bank advise.

Perhaps, but economic history unfolds one data point at a time. The next major hurdle is this Friday's April update for retail sales. For what it's worth, the crowd is optimistic. Econoday.com's consensus forecast calls for a strong rebound in spending for April following a modest slide in March. The outlook is for a 0.6% pop in sales for last month, a strong reversal after March's 0.2% dip.

Now the focus shifts to whether we will realize the second-quarter rebound or the rate of growth will continue to slow. The Atlanta Fed is currently forecasting a rate of growth of 4.2% for the second quarter, while the consensus of economists expects a rate that approximates 2.7%. Again, these are overly optimistic and I expect these estimates to be reduced dramatically as the quarter progresses. I see little improvement from the sub-1% rate of economic growth we saw in the first quarter. The only event that might alter this outlook is a return to real-income growth in the months ahead.

No comments:

Post a Comment